Freight Procurement 2025: Proven Logistics Strategies & Powerful Software Solutions

The transportation and logistics industry continues to face unprecedented challenges in 2025, from supply chain disruptions to evolving customer demands. As freight rates experience steady upward pressure with projections indicating significant gains by the second quarter of 2025, companies are increasingly recognizing that effective freight procurement has become a critical competitive advantage. Modern logistics procurement strategies must evolve beyond traditional approaches to incorporate advanced technology solutions. In this rapidly changing landscape, custom software solutions are emerging as the key to unlocking operational efficiency and cost optimization for comprehensive procurement logistics operations.

1. What is Freight Procurement and Why Does It Matter?

1.1. Definition of Freight Procurement

Freight procurement encompasses the strategic process of sourcing, negotiating, and managing transportation services to move goods from origin to destination. This complex discipline involves evaluating carrier capabilities, negotiating rates and service level agreements, managing contracts, and continuously optimizing transportation spend. Unlike traditional logistics procurement approaches, freight procurement requires real-time decision-making capabilities due to the dynamic nature of transportation markets and capacity constraints.

In 2025, freight procurement has evolved beyond simple rate comparison to become a sophisticated orchestration of data analytics, market intelligence, and strategic relationship management. A comprehensive logistics procurement strategy now requires integration with environmental compliance measures, particularly as companies adapt to regulatory changes including the EPA’s Clean Truck standards, while addressing increasing customer expectations for transparency and sustainability throughout procurement logistics processes.

1.2. The Role of Freight Procurement in T&L Companies

Freight procurement serves as the backbone of transportation and logistics operations, directly impacting both cost structure and service quality. For T&L companies, effective logistics procurement strategies can mean the difference between profit and loss, especially in a market where Class 8 truck orders fell 30% in January 2025, creating ongoing capacity challenges.

The function extends beyond cost savings to encompass risk management, ensuring service continuity even during market volatility. With the global logistics software market projected to grow from $19.39 billion in 2025 to $39.66 billion by 2033, companies that invest in sophisticated logistics procurement capabilities are positioning themselves for long-term success. Strategic freight procurement enables T&L companies to build resilient supply chains, maintain competitive pricing, and deliver consistent service levels that meet evolving customer expectations.

2. Common Pain Points in Freight Procurement

2.1. Fragmented Carrier Data and Manual Processes

One of the most significant challenges facing freight procurement teams in 2025 is the fragmentation of carrier data across multiple systems and platforms. Many organizations still rely on spreadsheets, emails, and disparate databases to manage carrier information, leading to inefficiencies and increased risk of errors in their logistics procurement operations. This fragmentation becomes particularly problematic when procurement teams need to quickly evaluate carrier options during peak seasons or capacity constraints.

Manual processes compound these challenges, with traditional rate acquisition taking an average of 48 hours compared to less than 30 seconds with digital freight rate management tools. These legacy approaches not only slow down decision-making but also create opportunities for human error in contract management, rate comparisons, and carrier selection within procurement logistics workflows. As transportation markets become increasingly dynamic, companies that continue to rely on manual processes find themselves at a significant competitive disadvantage.

2.2. Lack of Visibility and Real-Time Insights

The absence of real-time visibility into freight markets, carrier performance, and transportation spend represents a critical blind spot for many T&L companies. Without access to current market data and performance metrics, procurement teams struggle to make informed decisions about carrier selection, routing optimization, and contract negotiations. This lack of visibility becomes even more challenging when dealing with the complexity of modern supply chains that span multiple modes, geographies, and service providers, requiring sophisticated logistics procurement strategy development.

Real-time insights are essential for responding to market fluctuations, capacity constraints, and service disruptions. Companies without proper visibility tools often discover performance issues or cost overruns only after they’ve impacted customer service or profitability. In 2025’s volatile transportation market, where freight rates are experiencing steady upward pressure, the ability to access and act on real-time data has become a fundamental requirement for successful freight procurement and effective logistics procurement management.

2.3. Poor Collaboration Between Procurement and Operations

The disconnect between procurement and operations teams continues to plague many T&L organizations, creating inefficiencies that ripple throughout the supply chain. Procurement teams focused on cost optimization may select carriers or routes that create operational challenges, while operations teams may make transportation decisions that undermine carefully negotiated contracts and pricing agreements within their logistics procurement strategy framework.

This siloed approach becomes particularly problematic when dealing with customer-specific requirements, service level agreements, or emergency situations that require rapid coordination between teams. Poor collaboration often results in suboptimal carrier utilization, missed opportunities for consolidation, and inconsistent service delivery across procurement logistics operations. As customer expectations continue to rise and margins remain under pressure, organizations must break down these silos to achieve truly optimized freight procurement outcomes.

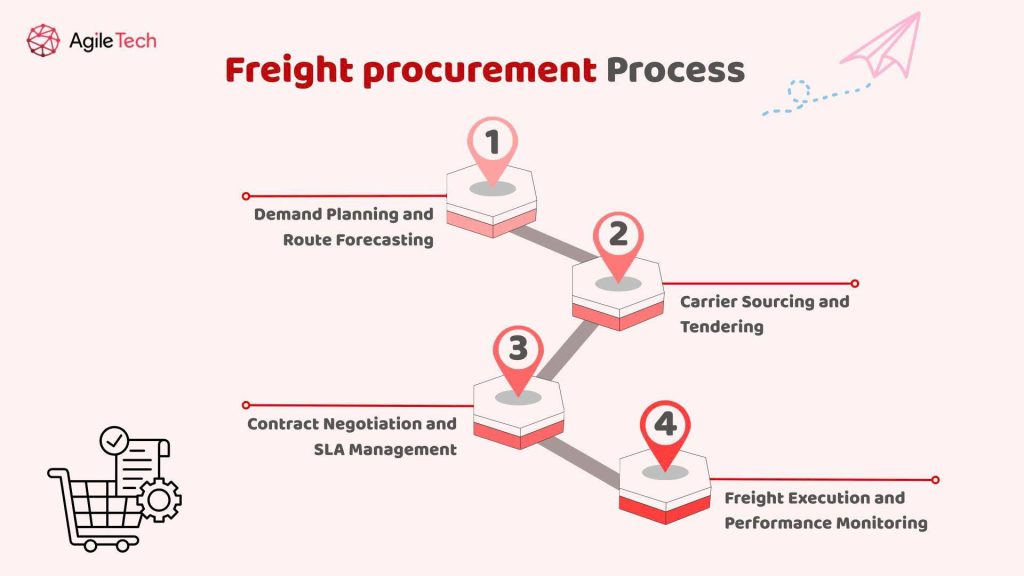

3. Key Steps in an Effective Freight Procurement Process

3.1. Demand Planning and Route Forecasting

Effective freight procurement begins with comprehensive demand planning and route forecasting that provides the foundation for all subsequent procurement decisions. This process involves analyzing historical shipping patterns, seasonal variations, and growth projections to anticipate future transportation needs. Advanced analytics and machine learning algorithms can identify trends and patterns that human analysts might miss, enabling more accurate forecasting and better procurement planning within comprehensive logistics procurement strategies.

Route forecasting extends beyond simple lane analysis to consider factors such as capacity constraints, regulatory requirements, and market dynamics. With ongoing staff shortages hampering sectoral activity and growth in 2025, companies must be particularly strategic about route planning to ensure service continuity. Successful demand planning also incorporates input from sales, marketing, and operations teams to ensure alignment between business objectives and transportation strategies within the broader procurement logistics framework.

3.2. Carrier Sourcing and Tendering

The carrier sourcing and tendering process has evolved significantly with the adoption of digital platforms and automated workflows. Modern tendering processes leverage technology to quickly identify qualified carriers, distribute requests for proposals, and evaluate responses based on predefined criteria. This digital transformation has reduced the time required for carrier sourcing while improving the quality and consistency of procurement decisions within logistics procurement operations.

Effective carrier sourcing in 2025 requires a balanced approach that considers not only cost but also service quality, financial stability, technology capabilities, and sustainability commitments. With companies increasingly focused on disclosing their environmental impact, including Scope 3 emissions throughout the supply chain, carrier selection must incorporate environmental criteria alongside traditional metrics in their logistics procurement strategy. The tendering process should also account for capacity constraints and market conditions that may affect carrier availability and pricing.

3.3. Contract Negotiation and SLA Management

Contract negotiation in the current transportation environment requires sophisticated understanding of market dynamics, carrier capabilities, and operational requirements. Successful negotiations go beyond rate discussions to encompass service level agreements, performance metrics, liability provisions, and flexibility clauses that address market volatility. With transportation markets experiencing significant fluctuations, contracts must include mechanisms for addressing capacity constraints and rate adjustments within comprehensive procurement logistics frameworks.

Service Level Agreement (SLA) management has become increasingly critical as customer expectations continue to rise. Effective SLA management involves establishing clear performance metrics, implementing monitoring systems, and creating accountability mechanisms that ensure consistent service delivery throughout freight procurement processes. Companies must also build flexibility into their agreements to accommodate changing business requirements and market conditions while maintaining cost effectiveness.

3.4. Freight Execution and Performance Monitoring

The execution phase of freight procurement requires seamless coordination between procurement decisions and operational activities. This involves translating negotiated agreements into executable transportation plans, managing day-to-day carrier relationships, and ensuring compliance with contracted terms. Effective execution relies on integrated systems that provide visibility into shipment status, carrier performance, and cost tracking across all procurement logistics activities.

Performance monitoring extends beyond basic metrics to include comprehensive analysis of carrier performance, cost effectiveness, and service quality. Advanced analytics platforms can identify trends, exceptions, and opportunities for improvement that might otherwise go unnoticed. With AI-driven procurement platforms demonstrating the ability to reduce costs by up to 15% while improving supplier transparency and contract efficiency, companies are increasingly investing in sophisticated monitoring and analytics capabilities for their logistics procurement operations.

4. Why AgileTech’s Custom Freight Procurement Software Is the Answer

4.1. Tailored to Your Workflow

AgileTech’s custom freight procurement software recognizes that every transportation and logistics company has unique operational requirements, business processes, and competitive challenges. Unlike off-the-shelf solutions that force companies to adapt their processes to rigid software constraints, AgileTech’s approach begins with a comprehensive analysis of existing workflows and business requirements. This thorough understanding enables the development of solutions that enhance rather than disrupt established operations.

The customization extends to user interfaces, reporting capabilities, and integration points that align with how procurement teams actually work. By tailoring the software to existing workflows, companies can achieve faster adoption, reduced training requirements, and immediate productivity improvements. This approach is particularly valuable in 2025’s competitive environment, where the ability to quickly adapt to changing market conditions can determine success or failure in freight procurement initiatives.

4.2. Integrates with Existing Systems

System integration represents one of the most critical success factors for freight procurement software implementation. AgileTech’s solutions are designed with integration as a core capability, ensuring seamless connectivity with existing ERP systems, transportation management systems, warehouse management systems, and carrier networks. This integration eliminates data silos, reduces manual data entry, and provides comprehensive visibility across the entire supply chain and logistics procurement processes.

The integration capabilities extend to external data sources, including market intelligence platforms, carrier APIs, and industry databases that provide real-time information for procurement decisions. With 91% of supply chain, logistics, and transportation companies reporting heavy usage of logistics IT solutions, the ability to integrate with existing technology infrastructure has become a fundamental requirement for effective logistics procurement strategy implementation. AgileTech’s approach ensures that custom solutions enhance rather than replace existing technology investments.

4.3. Centralized, Scalable, and Secure

AgileTech’s freight procurement platform provides a centralized hub for all procurement-related activities, data, and decision-making processes. This centralization eliminates the inefficiencies associated with fragmented systems while providing a single source of truth for procurement performance, carrier relationships, and cost management. The centralized approach also facilitates better collaboration between procurement and operations teams by providing shared visibility into transportation activities and performance metrics across all procurement logistics functions.

Scalability is built into the platform architecture to accommodate business growth, seasonal variations, and changing market conditions. As companies expand their operations or enter new markets, the software can adapt to support increased transaction volumes, additional carriers, and new operational requirements. Security features include robust data protection, user access controls, and compliance capabilities that meet industry standards and regulatory requirements, ensuring that sensitive procurement data remains protected while enabling necessary business functions across all freight procurement and logistics procurement activities.

Conclusion

The freight procurement landscape in 2025 presents both unprecedented challenges and remarkable opportunities for transportation and logistics companies. As market dynamics continue to evolve with capacity constraints, regulatory changes, and increasing customer expectations, the need for sophisticated logistics procurement capabilities has never been greater. Companies that continue to rely on manual processes and fragmented systems will find themselves increasingly disadvantaged in this competitive environment.

Custom software solutions represent the most effective path forward for organizations seeking to optimize their freight procurement processes. By addressing the specific pain points of fragmented data, limited visibility, and poor collaboration, these solutions enable companies to make better decisions, reduce costs, and improve service quality. The key steps of demand planning, carrier sourcing, contract negotiation, and performance monitoring become significantly more effective when supported by tailored technology platforms integrated with comprehensive logistics procurement strategy frameworks.

AgileTech’s approach to custom freight procurement software provides the foundation for long-term success by ensuring solutions are tailored to unique workflows, integrated with existing systems, and built for scalability and security. As the logistics software market continues its rapid growth trajectory, companies that invest in custom solutions today will be best positioned to capitalize on future opportunities and navigate the challenges that lie ahead in the evolving transportation landscape. Organizations that embrace advanced procurement logistics technologies will gain competitive advantages through improved efficiency, cost optimization, and enhanced service delivery capabilities that drive sustainable business growth.